The obvious reason anyone invests in anything is to preserve and grow wealth.

Beyond this basic reason, though, the motivations for passive income investments are the choice vary greatly.

Some choose passive investing to:

- Grow wealth while at the same time providing more time freedom

- Committed to other endeavors and have less time to focus on investment activities

- Build legacy wealth to transfer to the generations that follow them.

Looking into the lives of those who have explored passive income investments will provide insight into why passive income investments are attractive

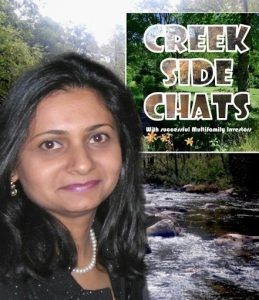

One example is Sandhya Seshadri, who had a very successful career in IT. Sandhya was a guest on my podcast Creek Side Chats. She appeared twice, episodes 100 and 143.

Sandhya began her career as an IT engineer. As her income increased she began to invest savings in the stock market.

She reached the point where her investment income surpassed the income from her W-2 job and left the corporate world to become a full-time investor.

However, every April, the thrill of having an income from the Wall Street Market was diminished as much of her earnings were eaten away by taxes.

Sandhya began looking for tax shelters and soon discovered the many tax advantages of real estate syndication investing.

As she became familiar with the world of real estate investing, she made her first investments as a completely passive investor.

She discovered that investing savings in passive income-producing real estate syndication wasn’t any more difficult than investing in Wall Street. . .

Even better, her investment returns usually brought her better returns than her stocks.

Best of all, though, when April rolled around, she kept most if not all of her earnings due to the tax advantages that real estate syndication provides but that Wall Street investing does not.

Though it has been very rewarding financially, the experience has also been personally fulfilling.

Sandhya takes pleasure and pride in sharing with her family the before and after aspects of the real estate syndication projects she has helped bring to fruition.

Any educated professional already has what it takes to succeed as a passive real estate investor.

We don’t go through years of higher education without already being able to become an abundantly successful passive real estate investor.

In fact, it takes much more personal character and overall stamina to attain a higher education degree than it does to be a successful passive investor.

Nevertheless, you want to prepare yourself before blindly leaping into the world of passive real estate investing.

To assist other professionals in the launch of their journey to abundant passive real estate investing, I created an informative video: Real Estate Investing Reimagined.

In the video, we’ll discover, among other things. . .

How you, as a busy, fulfilled professional, can reclaim your time while developing wealth by:

- Applying the 5 elements that make real estate the superior wealth-building investment

- Securing your nest egg with tangible and appreciating investment assets

- Diversifying your retirement funds

We’ll also address the scams to avoid and what not to do.